Key points:

Quality Concerns and Reforms:

- Recent abuse and neglect cases have emphasised the need for fundamental reforms in aged care.

- The Royal Commission into Aged Care Quality and Safety in 2019 catalysed a call for significant changes.

Key Drivers Shaping the Future:

- Demographic shifts towards an ageing population drive demand for age-appropriate accommodation and care services.

- Government expenditure on aged care is increasing, focusing on a change from residential to home care.

Australia’s aged care landscape is substantially transforming, driven by a rapidly ageing population and necessary policy reforms. As the nation grapples with demographic shifts and changing care needs, the Aged Care Residential Services industry is significantly evolving. Providers are now adapting their offerings to meet a diverse range of lifestyle accommodation options for older individuals, emphasising age-appropriate housing and tailored care.

However, this evolution is occurring in a challenging operational environment. Quality concerns regarding care provided by aged care residential providers have taken centre stage following a series of highly publicised cases of abuse, neglect, and negligence. These concerns culminated in the Royal Commission into Aged Care Quality and Safety in 2019, sparking a call for fundamental reforms in Australia’s aged care sector. Navigating this evolving landscape while ensuring compliance with regulations and striving for excellence in care delivery is where the Health Care Providers Association (HCPA) can provide crucial assistance.

A Changing Landscape

The challenges facing aged care providers are multifaceted. They encompass regulatory scrutiny, higher compliance and operational costs, funding and profitability pressures, and declining occupancy rates. The impact of the COVID-19 pandemic has further exacerbated these challenges, with aged care homes facing prolonged scrutiny and outbreaks.

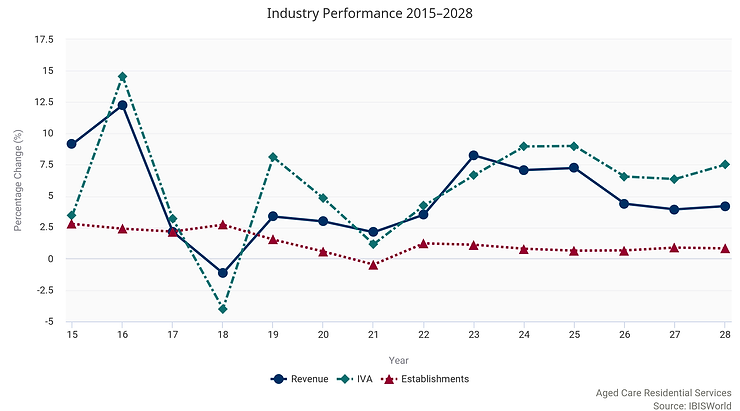

The industry is experiencing steady revenue growth. Revenue is anticipated to rise at an annualised rate of 5.4% over the five years to 2027-28, reaching an estimated $38.2 billion. This growth is propelled by additional government funding and a shift toward a more competitive, consumer-driven market.

HCPA is a trusted support partner dedicated to assisting aged care providers in delivering the highest standards of care and compliance with the complex regulatory landscape.

Current performance

Revenue is expected to grow at an annualised 4.0% through the end of 2022-23, including an estimated growth of 8.3% in 2022-23 alone, to total an expected $29.4 billion, with profit margins declining to an estimated 1.2%. Revenue for the Aged Care Residential Services industry is forecast to grow at an annualised 5.4% to an estimated $38.2 billion over the five years to 2027-28 when profit margins are estimated to improve to 2.9%.

Key Drivers Shaping the Future

Understanding the drivers shaping the aged care sector is crucial to navigating this shifting landscape effectively. Several key factors are significantly influencing the industry:

- Population Aged 70 and Over: The demographic shift towards an ageing population drives the demand for age-appropriate accommodation and care services. Greater demand for suitable housing and services for those over 70 presents an opportunity for industry expansion.

- Government Expenditure on Aged Care Services: Government expenditure on aged care services has witnessed a substantial increase, with a shift in focus from residential to home care. Adequate funding for in-home care can impact the demand for residential aged care services.

- Average Weekly Hours Worked: Changes in average weekly hours worked affect families’ capacity to care for ageing relatives, potentially boosting demand for aged care residential services.

- Cash Rate: Interest rates play a role in upgrading and constructing aged care facilities, impacting overall costs.

Navigating the Future: Overcoming Challenges

To navigate the evolving landscape and maximise the opportunities presented by a changing aged care sector, providers must focus on several key strategies:

- Regulatory Adherence and Enhancement: Staying compliant with evolving regulations and embracing new regulatory requirements, such as the aged care code of conduct and star rating system, will be critical. HCPA could provide guidance and support in understanding and adhering to the complex regulatory landscape.

- Efficiency in Funding Utilisation: Leveraging new funding models like the AN-ACC subsidy model effectively and advocating for additional funding reforms to ensure sustainability.

- Embracing Structural Reforms: Adapting to structural changes like shifting aged care places to individuals and removing bed licences by investing in innovation and scaling operations. HCPA can provide insights and strategies for embracing and implementing structural reforms.

- Addressing Workforce Challenges: Addressing labour shortages and rising wage costs through efficient resource allocation, workforce training, and seeking government assistance.

In conclusion, while the aged care sector faces significant challenges, it is also at the cusp of transformation. Adapting to these changes strategically, staying compliant with regulations, and focusing on improving the quality of care with the support of organisations like HCPA are vital steps to ensure a sustainable and impactful future for the aged care industry in Australia.

HCPA is an all-in-one solution for Aged Care providers, supporting them with registration, growth and consulting. Contact us here or call 03 9084 7472 to learn how we can help you succeed.

SOURCES | IBISWorld ‘Aged Care Residential Services in Australia’ |