Key Points:

- It is expected that significant market consolidation will occur, given the ongoing pressures on financial sustainability, particularly for providers in regional, rural and remote locations.

- The aged care workforce remains a critical issue. Providers need help to attract and retain qualified, skilled and experienced staff.

- The new requirements for mandated care minutes and registered nurses onsite 24/7 at residential aged care homes are exacerbating this issue.

- To reach optimal operational and business performance, it will be critical for providers to have systems that can analyse data to support efficient operations and reporting, plus innovative models for delivering support operations.

Australia’s aged care sector is in the midst of a transformative period, witnessing notable shifts in provider dynamics, consumer demographics, and overall market growth. In this article, we’ll explore the current state of the aged care landscape, highlighting key trends and developments shaping the industry. HCPA, an all-in-one solution for Aged Care providers, is vital in supporting providers in this evolving landscape.

The Market Landscape

The aged care market in Australia remains highly diverse, comprising 846 home care providers and 698 residential aged care providers. However, this landscape has seen a 2.4 per cent decrease in home care providers and a 4.3 per cent decrease in residential aged care providers since FY21. This reduction can be attributed to market consolidation, driven by the challenges of financial sustainability and heightened regulatory demands.

Merger and acquisition activities continue to be a defining feature of the sector. Providers are actively seeking opportunities to enhance their scale and influence in the market. Significant transactions, such as Calvary’s acquisition of ASX-listed Japara and Bolton Clarke’s strategic acquisitions, including Allity and McKenzie Aged Care, have reshaped the competitive landscape.

Consumer Demographics

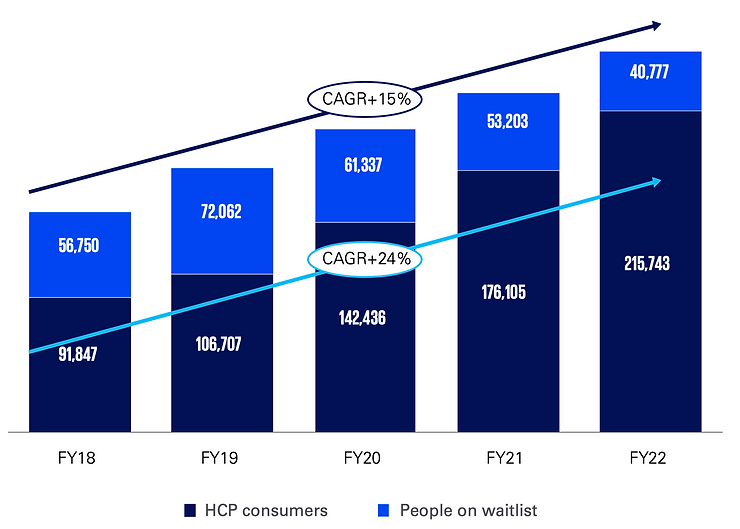

HCPA assists providers in understanding and meeting the changing needs of their clients, ensuring they can provide quality care to a growing demographic. As of December 2022, 235,599 individuals were accessing Home Care Packages, marking a remarkable 19 per cent increase from the previous year. This surge can be primarily attributed to the Australian Government’s concerted efforts to release additional packages into the market. The supply injection has effectively reduced the number of people waiting for a Home Care Package at their approved level, with a remarkable 45 per cent decrease in just 12 months.

Provider Landscape

Three main categories characterise the aged care provider landscape:

- Not-for-profit Providers: Comprising charitable, religious, and community-based organisations, this segment remains the largest, accounting for 55 per cent of the market as of June 2022.

- For-profit Providers: As of June 2022, for-profit providers represented 33% of the market. Notably, the largest home care providers by market share fall within the for-profit category.

- State and Local Government Providers: This government segment constitutes 12 per cent of the market and tends to operate in regional, rural, or remote areas, serving as a provider of last resort.

The Changing Face of the Home Care Package Market

FY22 witnessed substantial growth in the Home Care Package market, driven by increased government funding and the release of additional packages.

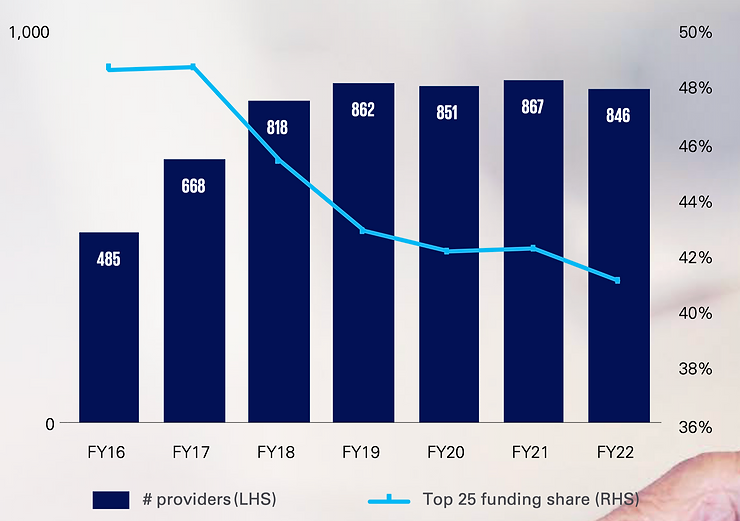

Figure 1: Number of HCP Providers (LHS) and top 25 market share

Government funding saw a significant 23 per cent increase between FY21 and FY22. This supply growth corresponds with a change in the mix of Home Care Package levels, with more consumers now accessing level 3 and 4 packages (54.4 per cent in December 2022 compared to 45.6 per cent in December 2021).

This robust market expansion unfolds amid a tight labour market and intensifying competition among providers to attract and retain home care workers. Some providers are exploring innovative solutions, including alternative employment models, transitioning from casual to permanent staff, and enhancing employee compensation and benefits. Additionally, strategic acquisitions of other businesses have become a common tactic to expand their client base and secure a reliable workforce. HCPA helps providers adapt to this growth by offering innovative solutions to attract and retain home care workers.

Despite overall market growth, there was a net decrease in the number of providers in FY22, primarily driven by exits from government providers. The forthcoming introduction of a new single in-home aged care program in July 2025 will transform the landscape as providers prepare to adapt to upcoming reforms.

In FY22, the top 25 home care providers received 41% of government funding. This marks a slight decrease from 49 per cent in FY16, indicating increased competition and provider growth over the years. Moreover, the top 25 providers have expanded their geographic reach, operating across more states and territories.

Private providers have emerged as prominent players within the top 25, accounting for 28 per cent in FY22 compared to 20 per cent in FY21. Noteworthy newcomers include Caring Group and Five Good Friends, recognised for their innovative service delivery models.In contrast, KinCare has experienced a drop in market ranking, highlighting the evolving dynamics of the aged care sector.

Market Growth

The Home Care Package market has grown substantially, driven by increased available packages. This expansion aligns with the preference of older Australians to age in their homes. Significantly, unmet demand is gradually decreasing as more packages become available, exceeding the growth rate of 80 years and overpopulation. HCPA supports providers in managing this growth, ensuring they can meet the increasing demand for aged care services.

Figure 2: Number of home care consumers + waitlist

In conclusion, the Australian aged care market is undergoing profound changes, characterised by increased competition, shifting consumer demographics, and ongoing regulatory reforms. Providers must adapt to these evolving trends to meet the rising demand for aged care services while upholding quality and sustainability. Innovation, strategic mergers, and a steadfast commitment to delivering personalised care to older Australians will shape the industry’s future.

Australia’s Home Care Package market is experiencing a transformative phase, driven by increased government funding, shifting demographics, and dynamic provider dynamics. As the aged care sector adapts to meet the evolving needs of older Australians, further consolidation, competition, and innovation are poised to shape its future, ensuring better care and support for the ageing population.

HCPA is an all-in-one solution for aged care providers, supporting them with registration, growth and consulting. Contact us now here or call 03 9084 7472 to learn how we can help you succeed.

SOURCES | KPMG ‘Australian aged care sector analysis 2023’ |